|

||||

|

||||

Technologies on Display

E4 - Financial Data Mining

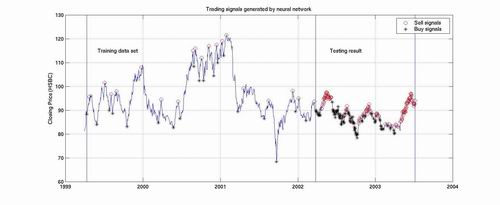

Application of neural networks to financial forecasting has been shown to be a promising approach. In recent years, neural networks have been successfully applied to stock price and trend prediction, exchange rate forecasting, bond rating, mortgage risk assessment, etc. In this project, we apply neural networks to portfolio trading in Hong Kong stocks. Based on historical information on stock prices, out portfolio trading system discovers knowledge of the stock price patterns. For single stock trading, the system generates buy or sell signals for users to make final decisions. For multi-stock trading, the system predicts future stock prices. The predicted results are passed to the trading module which would dynamically assign the weightings of the stocks in the portfolio. The trading module is also being trained by a neural network model. This trading module considers the maximization of the expected return and the minimization of the portfolio risk.

Applications

- Stock price and trend prediction

- Exchange rate forecasting

- Trading signal generations (when to buy or sell)

- Signals for users to make final decisions

- Dynamical asset allocations in portfolios

Features

- Capable to learn from historical data

- Knowledge is obtained from data

- Some personal preference may be included

Principal Investigator

Prof. L. W. Chan

Department of Computer Science and Engineering

¡@